Unpleasant arithmetics at the Central Bank of Iraq

Page 1 of 1

Unpleasant arithmetics at the Central Bank of Iraq

Unpleasant arithmetics at the Central Bank of Iraq

Monday, 27 May 2013

In its conflict with the central bank, the Iraqi

government got its economics wrong. Twice.

The last few weeks saw a

further decline in the value of the Iraqi dinar. The

gap between market and the official exchange rates reached its peak in the

second week of May when the dollar was being sold for around 1290 dinars; 10%

above the official rate of 1166 dinars to the dollar. This might be surprising

since for several years prior to 2012, the Central Bank of Iraq (CBI) managed

to maintain a narrow gap between the official and market rates using

its daily currency auctions.

The story of how the Iraqi

foreign exchange market went from stability to volatility in the space of 18

months can be divided into three episodes.

Episode 1 (Jan 2012 – May 2012): Two explanations for

an emerging gap

In early 2012, The CBI and

the government offered two different explanations for a newly-emerging gap emerged

between official and market exchange rates. Mudher Salih, then the deputy governor

of the CBI, attributed the gap to excess demand from the neighbouring Syria and

Iran—which were facing foreign currency shortages due to sanctions. Meanwhile, Izzat Al-Shahbandar,

an MP and an aide to PM

Maliki, blamed the stringent measures of the CBI, which hindered the

foreign currency

supply, for the emergence of the gap. Shahbandar claimed that prior to

2012, the CBI sold $200 million on average in its daily auctions, but

that figure fell to

$100 million in 2012.

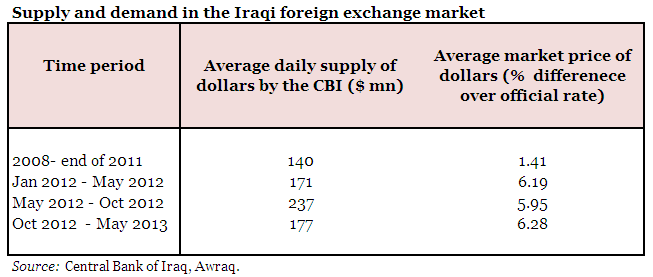

Contrary to Shahbandar’s

claims however, CBI’s data (summarised in the table below) show that the amount

of dollars sold had in fact increased in

the

period from January to May 2012 relative to previous years. The data

leaves

little doubt which of the two explanations is more plausible - the only

question mark is about the source of Shahbandar's figures.

Episode 2 (May 2012 – Oct 2012): The CBI increases

supply and gets its governor sacked

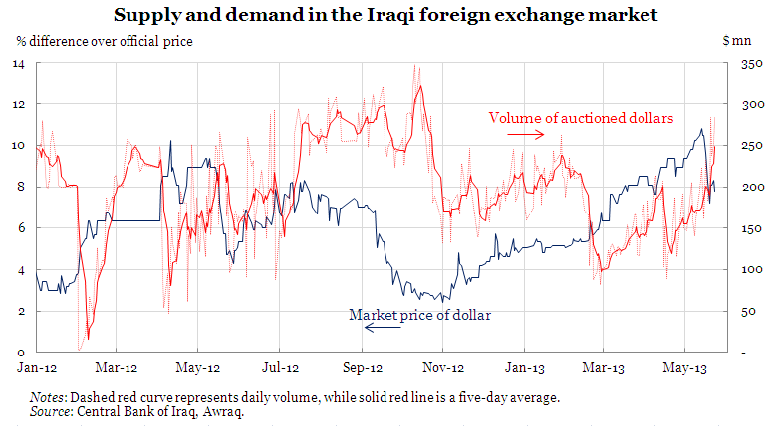

To meet the excess demand,

the CBI significantly increased its supply of dollars, successfully bringing

the market price down to within 3% of the official rate in early October (see the

chart below). At that point, an arrest warrant was issued against its governor,

Sinan Al-Shabibi, over allegations of “of financial irregularities” related to the currency

auctions. A more detailed report by the Board of Supreme Audit (BSA) concluded

that the CBI’s loose control over the auctions encouraged smuggling of the

dollar out of the country and money laundering.

The change in tone is

notable: in October, the CBI was being accused of leniency in running its

currency auctions, having been (falsely) accused of stringency in May!

Episode 3 (Oct 2012 – present): The CBI restricts

dollar supply

Over this period, volumes

in the CBI’s auctions averaged $177 million—a significant drop from the

previous episode. This appears to be a deliberate policy as can be inferred

from the appointment of the head of the BSA as the interim governor and CBI’s

statements on 18 and 24 October 2012.

An unsurprising outcome of

restricted supply is the significant rise in the market value of the dollar,

which reached a high this month. It is hard to tell what is going to happen

next, but the politicians who have been

actively involved in the saga now seem concerned with the uncomfortable fall of the

dinar.

Epilogue

The last part of the chart

shows a sharp pick-up in the auction volumes over the last few days (almost to the

levels reached by Shabibi before his dismissal) coupled with a narrowing of the

gap between market and official rates. It would be a positive change if this

trend continued. Currency smuggling, unnecessary depletion of CBI’s resources

and money laundering must be fought of course. But this should be done through

a legal and supervisory framework not through the excessively powerful tools of

monetary policy. One should not starve the patient to death in order to kill

the bacteria.

http://ziaddaoud.blogspot.com/2013/05/unpleasant-arithmetics-at-central-bank.html

In its conflict with the central bank, the Iraqi

government got its economics wrong. Twice.

The last few weeks saw a

further decline in the value of the Iraqi dinar. The

gap between market and the official exchange rates reached its peak in the

second week of May when the dollar was being sold for around 1290 dinars; 10%

above the official rate of 1166 dinars to the dollar. This might be surprising

since for several years prior to 2012, the Central Bank of Iraq (CBI) managed

to maintain a narrow gap between the official and market rates using

its daily currency auctions.

The story of how the Iraqi

foreign exchange market went from stability to volatility in the space of 18

months can be divided into three episodes.

Episode 1 (Jan 2012 – May 2012): Two explanations for

an emerging gap

In early 2012, The CBI and

the government offered two different explanations for a newly-emerging gap emerged

between official and market exchange rates. Mudher Salih, then the deputy governor

of the CBI, attributed the gap to excess demand from the neighbouring Syria and

Iran—which were facing foreign currency shortages due to sanctions. Meanwhile, Izzat Al-Shahbandar,

an MP and an aide to PM

Maliki, blamed the stringent measures of the CBI, which hindered the

foreign currency

supply, for the emergence of the gap. Shahbandar claimed that prior to

2012, the CBI sold $200 million on average in its daily auctions, but

that figure fell to

$100 million in 2012.

Contrary to Shahbandar’s

claims however, CBI’s data (summarised in the table below) show that the amount

of dollars sold had in fact increased in

the

period from January to May 2012 relative to previous years. The data

leaves

little doubt which of the two explanations is more plausible - the only

question mark is about the source of Shahbandar's figures.

Episode 2 (May 2012 – Oct 2012): The CBI increases

supply and gets its governor sacked

To meet the excess demand,

the CBI significantly increased its supply of dollars, successfully bringing

the market price down to within 3% of the official rate in early October (see the

chart below). At that point, an arrest warrant was issued against its governor,

Sinan Al-Shabibi, over allegations of “of financial irregularities” related to the currency

auctions. A more detailed report by the Board of Supreme Audit (BSA) concluded

that the CBI’s loose control over the auctions encouraged smuggling of the

dollar out of the country and money laundering.

The change in tone is

notable: in October, the CBI was being accused of leniency in running its

currency auctions, having been (falsely) accused of stringency in May!

Episode 3 (Oct 2012 – present): The CBI restricts

dollar supply

Over this period, volumes

in the CBI’s auctions averaged $177 million—a significant drop from the

previous episode. This appears to be a deliberate policy as can be inferred

from the appointment of the head of the BSA as the interim governor and CBI’s

statements on 18 and 24 October 2012.

An unsurprising outcome of

restricted supply is the significant rise in the market value of the dollar,

which reached a high this month. It is hard to tell what is going to happen

next, but the politicians who have been

actively involved in the saga now seem concerned with the uncomfortable fall of the

dinar.

Epilogue

The last part of the chart

shows a sharp pick-up in the auction volumes over the last few days (almost to the

levels reached by Shabibi before his dismissal) coupled with a narrowing of the

gap between market and official rates. It would be a positive change if this

trend continued. Currency smuggling, unnecessary depletion of CBI’s resources

and money laundering must be fought of course. But this should be done through

a legal and supervisory framework not through the excessively powerful tools of

monetary policy. One should not starve the patient to death in order to kill

the bacteria.

http://ziaddaoud.blogspot.com/2013/05/unpleasant-arithmetics-at-central-bank.html

Similar topics

Similar topics» The Central Bank of Iraq issued an explanation on the new edition of the currency Central Bank of Iraq

» Designed by Zaha Hadid .. Direct construction of the central bank building with 37 floors Central Bank of Iraq

» *****Central Bank issued new instructions to the membership of its daily auction for coins Central Bank of Iraq

» Central Bank raises custody by the Central Bank (via Iraq) after the lifting of capital to 150 billion dinars

» Central Bank looking at the mechanics of the development of its by Dubai Banking Central Bank of Iraq

» Designed by Zaha Hadid .. Direct construction of the central bank building with 37 floors Central Bank of Iraq

» *****Central Bank issued new instructions to the membership of its daily auction for coins Central Bank of Iraq

» Central Bank raises custody by the Central Bank (via Iraq) after the lifting of capital to 150 billion dinars

» Central Bank looking at the mechanics of the development of its by Dubai Banking Central Bank of Iraq

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum|

|

|

Home

Home